Australians are increasingly “thinking small” when it comes to buying a home and cracking the property market. And with perks like affordability, more desirable locations, and lower maintenance, it’s little wonder why.

Many Australians are crossing the McMansion off their wish list in favour of smaller, smarter, low-maintenance homes.

A recent ING study surveyed over 1000 Australians about their home preferences.

Over a quarter (26%) said the cost of maintaining and running a larger home would see them gravitate to a smaller abode.

And 19% said they’d consider a smaller outdoor area for ease of maintenance.

Australia has some of the biggest homes in the world, according to the 2020 CommSec Home Size Report. But it seems that there’s a swing in the other direction.

A 2022 Australian Bureau of Statistics (ABS) report shows that Australian homes are being built on smaller blocks, with a size decrease of 13% over the past 10 years in capital cities.

So why the switch to smaller homes?

What are two things we all wish we had more of?

Money and free time, am I right?

With the cost of living rising (as well as the cash rate!), cracking the property market can feel like a slog. But revising your wish list to include a smaller (and smarter) home could make it easier.

On average, smaller homes, townhouses, and units tend to be more affordable. And this can be a great option for those wanting to get into the housing market in a more attractive location.

But a smaller dwelling delivers other perks, too.

ING’s study highlighted the growing preference for lower-maintenance homes to simplify lifestyles.

According to the ABS, Aussies spend around three hours a day on domestic activities.

But a smaller space can reduce cleaning time. And with a smaller outdoor area, you can reclaim your weekend and say goodbye to all that gruelling yard work.

Also, smaller homes can be more efficient when it comes to energy consumption.

A smaller home may help make you eligible for government schemes

If you’re a first-time home buyer, the Home Guarantee Scheme could give you the extra boost you need to get into the market.

Being eligible could shave, on average, five years off your home-buying process.

The First Home Guarantee and Regional First Home Guarantee offer loans with a low deposit of 5% with no lenders mortgage insurance (LMI).

And the Family Home Guarantee offers eligible single parents loans with a deposit of just 2% and no LMI.

However, the eligibility criteria include property price caps that are dependent on the state and geographical area you buy in.

Opting for a smaller, more affordable property could help you meet the eligibility criteria and speed up your home-buying journey.

But get in quick as places are limited, with a fresh round of intakes available from July 1.

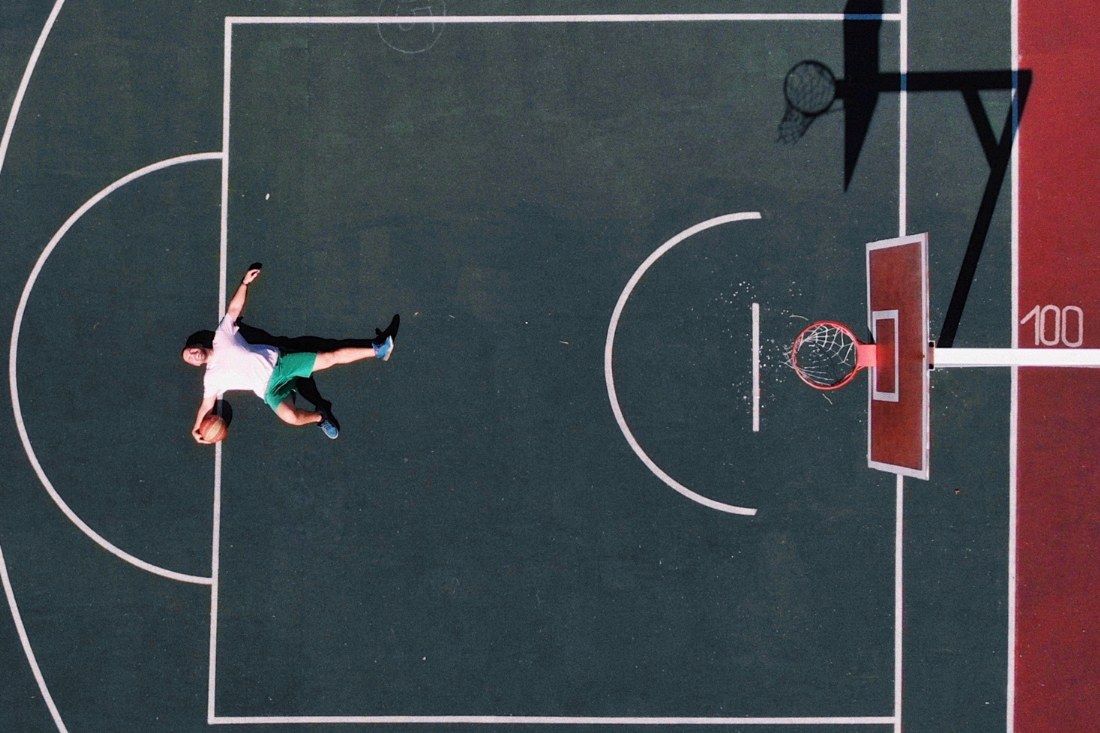

Get the ball rolling

While you search for the perfect small abode, we can get to work on the home loan hunt.

If you’re a first home buyer, we know all the ins and outs of applying for government schemes, like the Home Guarantee Scheme.

Not all lenders participate, but we know who does and can give you some options to compare.

We’re also clued in on other government schemes you may be eligible for to help stack up the savings.

So if you’d like to find out more, get in touch today.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.