Australia’s shift to renewable energy is gaining momentum fast, thanks to environmental awareness, nationwide clean energy targets, and rising electricity costs! Among all the major renewable sources claiming fame, solar power emerges as the most cost-effective and accessible option for Australian businesses and households alike.

However, the initial investment could be a barrier – making solar financing vital for Australians to embrace clean energy without overspending! Today, businesses and homeowners can choose from an array of solar loan options, generous government solar support programs, and innovative leasing models to offset costs and streamline their solar journey.

Did you know Australia’s typical 6.6 kW solar system is priced around $5,000–$9,000, excluding incentives orfunding options? As solar gains traction, understanding your payment choices is the key to switching to clean energy – without any financial strain.

Here’s a quick breakdown –

A Quick Summary

Looking to install solar panels anytime soon? Start with gaining a thorough understanding of your solar financing options. This guideline explains some surefire ways to fund your solar investment, right from government solar support to solar loan options. Read to learn how to slash upfront costs and boost long-term savings via smart financial strategies, too!

Solar Financing in Australia – What Is It?

Solar financing is the method Australians use to manage the overall expense of setting up solar energy systems. This usually includes rebates, loans, rental agreements, and energy purchase arrangements. No matter if you are a small business owner or a house-owner, picking the right financing option can impact how fast you see benefits from your solar panels.

- Typical Cost of Installation

| System Size | Estimated Cost (AUD) | Potential Annual Savings |

| 3kW | Around $3,500 – $5,000 | Around $500 – $800 |

| 5kW | Around $5,000 – $7,000 | Around $800 – $1,400 |

| 6.6kW | Around $6,000 – $8,500 | Around $1,200 – $1,800 |

Expert Take – “With the right payment option, most Australian households can recoup their solar investment within just 4-6 years.”

Solar Loan Options – What Are Your Top Picks?

One of the most widely popular paths to solar financingis through specialized solar loan options – secured or unsecured alike! All these solutions are tailored to help homeowners handle upfront solar expenses when benefiting from energy savings sustainably. Based on your financial goals and situation, you can make a choice from multiple flexible repayment structures.

- Green Personal Loans

- Provided by banks as well as credit unions

- Low interest rates (around 4–7%)

- Terms: 3 - 7 years

- Unsecured, quick approval

2. Secured Home Equity Loans

- Uses home values as collateral

- Lower rates, extended repayment periods

- Perfect for high-capacity installations

3. In-House Installer Finance

- Provided by solar retailers

- Fast and bundled with the system

- May incorporate higher interest

Pro Tip – Make sure that you compare rates between your solar providers and bank. Consider checking for early payoff charges penalties, and undisclosed fees.

Important Things to Ask Your Lender –

- Can I submit early repayments?

- Is the rate fixed or adjustable?

- Are rebates included in the loan total?

Government Solar Support – What You Can Access in Australia?

Both the state and federal programs of Australia provide a combination of subsidies, rebates, and zero-interest loans to reduce the cost burden.

- Federal Small-scale Technology Certificates (STCs)

- Apply Australia-wide

- Based on system capacity and location

- Automatically subtracted from your solar estimate

- State-Based Rebates

| State | Incentive Type | Benefit |

| VIC | Solar Homes Program | Approximately $1,400 rebate + interest-free loan |

| NSW | Empowering Homes Program | Zero-interest solar battery loan |

| SA | Home Battery Scheme | Subsidy for battery installations |

- Low-Income & Pensioner Programs

- Additional discounts or grants.

- Should meet concession or income criteria.

- Check your state energy website for the latest updates.

Do you want to learn more about how your system earns your credits? Check our blog, Solar Feed-in Tariffs Explained, to seal the deal!

Should You Buy, Lease, or Use a PPA?

Are you not willing or ready to buy outright? If yes, then you may consider a Power Purchase Agreement (PPA) or solar leasing. Each option brings their unique perks, cost structures, and long-term implications to the table for ownership and savings. Knowing the core differences can help you pick the most effective and affordable solar solution for your home.

- Solar Lease

- Pay a routine fee to "rent" the system.

- Maintenance is typically included.

- You don’t have ownership of the system.

- Power Purchase Agreement (PPA)

- Solar company sets up panels at no initial cost.

- You pay for the electricity you consume (at a lower rate than the grid).

- Contracts generally run for 10–20 years.

- Buying with Finance

- Full ownership as well as better returns.

- Eligible for every rebate.

- Higher upfront commitment.

| Option | Upfront Cost | Ownership | Eligible for Rebates | Maintenance |

| Lease | Low | No | No | Often yes |

| PPA | None | No | No | Yes |

| Buy (Loan) | Medium | Yes | Yes | Buyer |

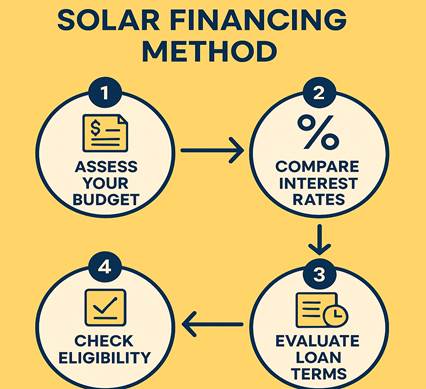

How to Pick the Right Solar Financing Method

This is certainly one of the most crucial considerations. Always remember – not every solar financing option is created equal. Here’s how to find the one that best suits your needs –

- Ask Yourself These Questions –

- Do I really want to own the system?

- Can I manage monthly repayments?

- Do I have the eligibility for federal or state support?

- How long can I stay in this property?

- Quick Guide to Match Your Goals

| Your Goal | Best Option |

| Max savings over 10–15 years | Purchase with a secured loan |

| Low upfront cost | Lease or PPA |

| Fast ROI with moderate spends | Green personal loan + rebate |

Frequently Asked Questions

1.Am I eligible for rebates if I fund my solar?

Yes, of course! Financing cannot impact your eligibility for your state rebates or STCs – as long as the system is eligible and new.

2. Is it a wiser decision to pay upfront or finance?

Well, it depends! Paying upfront brings maximum savings to the table. Financing distributes the overall expenses – perfect if you want solar without any further delay.

3. Are solar loans eligible for tax benefits in Australia?

For homeowners, no! However, if you're a business using solar, loan interest could be deductible. It’s advisable that you always consult your accountant for the best advice or results!

Takeaway: The Effective Way to Fund Solar in Australia

Solar financing paves the way for clean energy without any upfront price tag. No matter if you are exploring solar loan options via your bank or simply leveraging government solar support, the best route can always help you slash costs in the long run.

So, don’t let the upfront costs stop you – solar is more than just a passing fad! It’s rather a wise and eco-friendly investment for your house, finances, and the planet. To explore more, look into our blog on Solar Feed-in Tariffs Explained.